If you’re relocating or moving your personal effects and household goods via sea, air, or land, you’re well aware of the potential risks involved. Loss, damage, theft, or unforeseen incidents can threaten your valuable possessions during transit. To protect your assets, navigate complex regulations, and ensure a smooth relocation, marine insurance for personal effects and household goods is your saving grace.

But what exactly is marine insurance, and why is it indispensable for safeguarding your personal belongings during transit in Kenya? In this blog post, we will answer these questions and more. We will explain what marine insurance is, what it covers, what it does not cover, why it is necessary, how much it costs, whether it is mandatory, what are the benefits of taking it, and what is the claim process.

By the end of this post, you will have a clear understanding of everything you need to know about marine insurance in Kenya.

What is marine insurance?

Marine insurance is a type of insurance that covers the loss or damage of any goods that are transported by sea, air, and or land. It plays a crucial role in the maritime industry by mitigating the financial risks associated with the transportation of goods and vessels.

This type of insurance provides compensation for losses or damages to ships, cargo, terminals, and other assets involved in the transport of your personal and household items.

There are various types of marine insurance policies available in Kenya, including hull insurance for the ship itself, cargo insurance for the goods being transported, liability insurance for third-party claims, and other specialized coverage options, each tailored to specific needs within the maritime sector. These policies provide coverage for vessel owners, cargo owners, and other stakeholders involved in the shipping or the moving and relocation industry.

What does marine insurance cover for personal effects and household goods?

Marine insurance offers protection against a range of external risks that can lead to loss or damage to your personal effects and household goods. These include risks such as fire, explosion, collision, theft, hijacking, piracy, storm, and earthquake, among others. It also covers the expenses incurred to prevent or mitigate a loss, such as salvage, sue and labour, general average, etc.

However, the extent of coverage that marine insurance provides depends on the terms and conditions of the policy. Different types of clauses define the scope of marine insurance coverage in Kenya, as discussed below:

- Institute Cargo Clauses (C)

This clause offers coverage for a wide range of risks that your personal effects and household goods may face during transit. These risks include:

- Loss of or damage to the subject matter insured against fire or explosion; vessel or craft being stranded, grounded, sunk, or capsized; overturning or derailment of land conveyance; collision or contact of vessel, craft, or conveyance with any external object other than water; and discharge of cargo at a port of distress.

- It also provides coverage against loss or damage to the subject-matter insured caused by general average sacrifice and jettisoning of the cargo.

2. Institute Cargo Clauses (B)

Under Institute Cargo Clauses (B), the following risks are covered unless specifically excluded:

- Loss or damage resulting from risks such as fire or explosion, vessel or craft stranding, grounding, sinking, or capsizing, overturning or derailment of land conveyance, collision or contact with external objects, discharge of cargo at a port of distress, and natural events like earthquakes, volcanic eruptions, or lightning.

- loss or damage caused by general average sacrifice, jettison or washing overboard of the cargo, and the entry of sea, lake, or river water into the vessel, craft, hold, conveyance, container, lift van, or place of storage.

- Packages lost overboard or dropped during loading or unloading.

3. Institute Cargo Clauses (A)

Under Kenya’s marine insurance policy, the Institute Cargo Clauses (A) provides comprehensive coverage for all your personal effects and household goods transported by sea or air. The clauses cover all risks of loss or damage to the subject-matter insured including those covered by the other clauses such as Institute Cargo Clauses (B) and Institute Cargo Clauses (C), except as provided in specific exclusions. This broader coverage includes risks such as accidents, natural disasters, theft, and many other perils that can affect cargo during transit.

4. Institute War Clauses (Cargo)

The Institute War Clauses (Cargo) in Kenya provides coverage for specific risks associated with war and related events. These risks include:

- Loss or damage to the insured items caused by acts of war, civil war, revolution, rebellion, insurrection, or civil strife. It also includes damage arising from any hostile act by or against a belligerent power.

- Loss or damage resulting from the capture, seizure, arrest, restraint, or detainment of your goods, provided it is related to the risks mentioned above.

- Damage caused by derelict mines, torpedoes, bombs, or other abandoned weapons of war.

5. Institute Strikes Clauses (Cargo and Air Cargo)

In addition to the above clauses, marine insurance in Kenya may include Institute Strikes Clauses for the additional protection of your personal effects and household goods. These clauses cover losses, damages, or expenses resulting from strikes, lockouts, labour disturbances, riots, civil commotion, and any acts of terrorism for political motives. They are particularly relevant in regions prone to labour disputes or civil unrest.

It is also worth mentioning that the Institute Strikes Clauses have exclusions too – including those related to wilful misconduct and inherent vice or nature of the cargo.

All these clauses under marine insurance in Kenya also cover the general average and salvage charges. These charges are adjusted or determined according to the contract of affreightment and the governing law and practice, and they are incurred to avoid or mitigate loss from any cause except those excluded in the clauses.

What does marine insurance not cover?

While marine insurance provides comprehensive coverage for your personal effects and household items, certain exclusions are essential to understand. In Kenya, marine insurance does not cover the following:

- Losses, damages, or expenses resulting from the assured’s wilful misconduct.

- Losses resulting from ordinary leakage, ordinary loss in weight or volume, or ordinary wear and tear of the subject-matter insured.

- Losses caused by insufficiency or unsuitability of packing or preparation. However, this exclusion does not apply to stowage in a container or lift van carried out before insurance attachment or by the assured or their servants.

- Losses or damages stemming from the inherent vice or nature of the subject-matter insured.

- Losses, damages, or expenses primarily caused by delay, even if the delay results from a covered risk except for expenses payable under the general average and salvage charges.

- Losses arising from insolvency or financial default of vessel owners, managers, charterers, or operators.

- Deliberate damage or destruction of the subject-matter insured by wrongful acts.

- Losses resulting from the use of weapons of war employing atomic or nuclear fission, fusion, or radioactive force or matter.

- Losses or damages arising from the unseaworthiness or unfitness of the vessel, craft, conveyance, container, or lift-van for safe carriage of the subject-matter insured – especially if the assured or their servants are privy to such unseaworthiness or unfitness at the time of loading.

- Losses caused by war, civil war, revolution, rebellion, insurrection, or civil strife and any hostile acts related to belligerent powers.

- Losses arising from strikes, lockouts, labour disturbances, riots, civil commotion, and any acts of terrorism for political motives.

One, however, can cover these exclusions by insuring your personal effects and household goods with any of the additional clauses such as the Institute Strikes Clauses, for example. Nevertheless, it is important to carefully review the terms and conditions of the marine insurance policy to understand the full scope of coverage and the specific exclusions that apply in Kenya.

But also, important to note is that a marine insurance policy in Kenya usually includes other clauses such as:

- Co-Mingled Bulk Cargo Shipments Warranty: This clause addresses situations where the insured items are part of a bulk cargo shipment with multiple owners. It outlines how shortages will be shared among cargo underwriters when discovered during the collection of cargo.

- Documentation of Claims: To expedite the claims process, this clause requires the insured to provide documentation supporting the claim within a specified period, usually 30 days from the date of the loss.

- Unseaworthiness Exclusion Clause: This clause excludes coverage for loss or damage caused by the unseaworthiness of the vessel, craft, or conveyance unless caused by want of due diligence by the assured, owners, or managers to make the vessel seaworthy or to ensure that it is properly manned, equipped, and supplied.

- Free from Particular Average (FPA) Warranty: This clause excludes coverage for partial losses (particular average) unless the vessel is stranded, sunk, or burnt.

- Institute Radioactive Contamination, Chemical, Biological, Bio-Chemical, and Electromagnetic Weapons Exclusion Clause: This exclusion clause specifies that coverage does not extend to loss, damage, or expense arising from the use of certain weapons or substances.

- Institute Cyber Attack Exclusion Clause: With the increasing risk of cyberattacks, this clause excludes coverage for loss, damage, or expense caused by cyberattacks, unless a separate cyber insurance policy is in place.

Some clauses are specific to the insurer, and for that, you should always go through their marine insurance policy document to establish what cover you get and what it does not contain.

Why is marine insurance necessary when shipping your personal effects and household items?

Marine insurance is necessary for several reasons. For one, it facilitates international trade and commerce by reducing the risks and uncertainties involved in transporting goods across borders. Additionally, marine insurance supports the development of the maritime industry and economy by providing incentives and security for shipping activities.

Without marine insurance, individuals moving their personal effects and household goods would have to bear the full burden of any loss or damage. This could result in substantial financial losses and liabilities that could jeopardize their move and financial well-being.

Similarly, in an increasingly interconnected world, shipping personal effects and household items internationally is common. Marine insurance provides global coverage, enabling you to protect your belongings regardless of their destination. It ensures that you are protected no matter where in the world your items are being transported.

This is not to mention that professional shipping companies often require marine insurance, as it is a standard part of their service. This ensures that your belongings are handled with care, and in the event of any issues, the insurance can help resolve them more smoothly.

How much does marine insurance cost?

The cost of marine insurance is largely determined by the insurer based on their assessment of the risk involved in transporting your belongings. The risk is influenced by various factors, such as the type and nature of the goods, the packing and handling of the goods, the mode and carrier of transportation, the origin and destination of the voyage, the season and weather conditions, etc.

For example, if the goods are fragile or hazardous, they may have a higher marine insurance rate than if they are durable or harmless. Similarly, if the mode or carrier of transportation is unreliable or unsafe, they may have a higher marine insurance rate than if they are reliable or safe.

The terms and conditions of the policy also affect the cost of marine insurance. As mentioned earlier, different types of clauses define the scope of coverage. The wider the coverage, the higher the cost.

That said, it is important, therefore, to compare different policies from various insurance companies to choose one that fits your budget and needs.

Is marine insurance mandatory in Kenya?

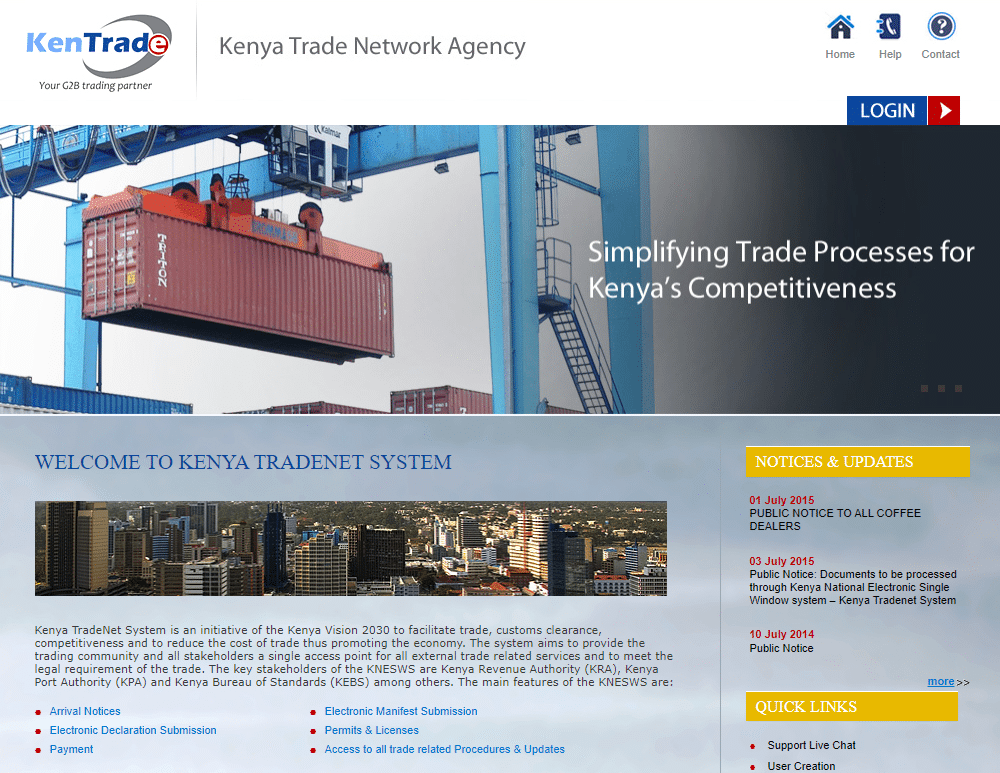

In Kenya, marine insurance is mandatory for all individuals who are relocating their personal effects and household goods into the country by sea or air. This is according to Section 20 of the Insurance Act Cap 390 of Kenya Law and Section 114A (2) (a) (ii) of The East African Community Customs Management Act 2004. The purpose of this regulation is to ensure that all imported goods are insured locally and to promote the growth of the local insurance industry.

According to this regulation, individuals must obtain marine insurance coverage from a licensed insurer in Kenya before clearing their goods at customs. They must also submit proof of insurance to the Kenya Revenue Authority (KRA) through an online portal called Kenya Trade Network Agency (KenTrade). KenTrade is a single-window system that facilitates trade documentation and clearance in Kenya.

If individuals fail to comply with this regulation, they will face penalties or delays from KRA and customs authorities. They may also lose their eligibility for duty remission or exemption schemes that are available for certain types of imports.

How to Obtain Marine Insurance for Personal Effects and Household Goods in Kenya

Obtaining marine insurance for personal effects and household goods in Kenya is a straightforward process that can be accomplished through various channels. You have the following options:

- Directly from the Underwriter: You can acquire marine insurance coverage directly from the underwriter. This approach allows you to interact with the insurer and negotiate terms to align with your specific needs.

- Through an Insurance Broker: Insurance brokers can provide you with a range of options and help you choose the best coverage based on your specific requirements. They act as intermediaries between you and insurance companies.

- Through Your Moving Company: For a convenient and hassle-free experience, consider obtaining marine insurance for your personal effects and household goods through your moving company. Many moving and relocation companies have established relationships with insurance providers and can facilitate the insurance process on your behalf.

If you’re seeking marine insurance coverage, consider reaching out to Nellions Moving and Relocations Company. Renowned for their excellent service and expertise, Nellions can guide you through the process of obtaining marine insurance for your personal effects and household goods, ensuring a secure and stress-free move.

Benefits of marine insurance

Marine insurance offers numerous benefits to individuals relocating their personal effects and household goods, ensuring a smooth and secure transition. Some key advantages include:

- Protection Against Financial Loss: Marine insurance provides financial protection against the myriad of risks associated with moving personal belongings and household goods. It safeguards individuals from substantial financial losses resulting from damage, loss, or theft during transit.

- Risk Management: Marine insurance enables individuals to manage and transfer risks effectively. By having coverage in place, individuals can focus on their relocation without worrying about the potential financial implications of unforeseen events.

- Facilitating Global Trade: Marine insurance plays a crucial role in global trade by providing assurance to parties involved in international commerce. It promotes trust and confidence among traders, shippers, and insurers, thereby supporting the smooth flow of goods across borders.

- Compliance with Contractual Obligations: Many contracts and international trade agreements require parties to have marine insurance in place. By complying with these obligations, individuals can participate in global trade without legal hindrances.

- Competitive Advantage: Individuals who offer marine insurance coverage to their clients can gain a competitive advantage in the marketplace. It serves as a valuable selling point, demonstrating their commitment to the safe and secure relocation of goods.

- Peace of Mind: Marine insurance provides peace of mind to individuals relocating their personal effects and household goods. It assures them that their financial interests are protected, even in the face of unexpected events.

What is the claim process?

Image Source: Freepik

Loss and damage during the relocation of personal effects and household goods are inevitable. Therefore, if you have taken up a marine insurance policy, understanding the claim process is essential to recovering your losses. Here’s how you can launch a marine insurance claim:

- Insurable Interest: To initiate a claim, the insured must have an insurable interest in the subject matter insured at the time of loss.

- Timely Notification: The Assured must promptly notify the Underwriters of the loss, providing all necessary details.

- Claim Period: Subject to the terms and conditions of the policy, the insured is entitled to recover for insured losses occurring during the period covered by the insurance, even if the loss occurred before the insurance contract was concluded.

- Increased Value Insurance: If the Assured has additional insurance covering the transported goods, the agreed value of the cargo increases proportionally. Evidence of amounts insured under all other insurances must be provided in case of a claim.

- Duty to Minimize Losses: The Assured must take reasonable measures to prevent or minimize a loss or damage to the subject-matter insured.

- Salvage and Contribution: In cases involving salvage or contribution to the general average, the Assured must act in accordance with the contract of affreightment and relevant laws and practices.

- Claim Submission: A written notice of the claim, accompanied by relevant documents and particulars, must be submitted to the Underwriters. This notice should include:

- Details of the insurance policy.

- Description of the subject matter insured.

- Nature and extent of the loss or damage.

- Estimated amount of the loss.

- Supporting documents, such as invoices, packing lists, survey reports, and bills of lading.

- Adjustment of Loss: The Underwriters will appoint an adjuster to assess the loss or damage. The adjuster will examine the documentation provided and may conduct surveys or investigations as necessary.

- Payment of Claims: Upon the completion of the adjustment process, the Underwriters will make a payment to the insured in accordance with the terms and conditions of the policy.

- Subrogation: In cases where a third party is responsible for the loss, the Underwriters may exercise their right of subrogation to recover the amount paid to the insured. This involves pursuing legal action or negotiations with the responsible party.

Keep in mind, however, that the claim process may vary depending on the type and extent of the loss or damage, the terms and conditions of your policy, and the service level agreement between you and your insurer, broker, or moving company. You should always read and understand your policy document before making a claim.

The claim process for marine insurance for personal effects and household goods is important because it helps you to recover from your losses and resume your operations. It also helps to enhance efficiency, transparency, and customer satisfaction in the insurance industry.

Conclusion

Marine insurance is an essential component of ensuring the safe and secure relocation of personal effects and household goods either by sea, air, and or land. It safeguards against the risks of loss or damage during transit and provides peace of mind to individuals during a significant life change. In Kenya, marine insurance is regulated by the Marine Insurance Act cap 390 of the Kenyan Law, which requires all importers and or individuals relocating goods by sea or air to have local marine insurance coverage in place. This means that you cannot rely on the foreign seller’s insurance policy, but you have to purchase your cover from a licensed insurer in Kenya.

Before making your decision, however, ensure that you compare their products, prices and services. Also, keep in that finding the right insurer is only half the battle. You also need a reliable and professional moving company that can handle your logistics and customs clearance needs – Nellions Moving and Relocations Company, a leading provider of moving and relocation services in Kenya and beyond is a good example.

Nellions can help you choose a trustworthy insurer and policy for your marine insurance needs, as well as assist you with packing, loading, transporting, storing, and delivering your personal effects and household items safely and efficiently. With a reputable name in the industry and a network of partners, Nellions offers competitive rates and flexible solutions for any size and type of shipment.

Reach out today for a free quote and consultation and let your marine insurance and moving needs be a hassle-free experience.